Short-Term Financing: How Not to Get Ripped Off

By James Pruitt, Senior Staff Writer

Short-term credit often provides vital sustenance to a new business. Short-term creditors also commonly predate on fresh entrepreneurs. Regardless of need, business owners should use such lenders cautiously.

“Loan sharks” can suck businesses dry in their times of vulnerability. This stage of the pandemic likely exposes the vulnerabilities of many businesses. Small businesses now likely struggle with debts as well as labor and inventory shortages. Predatory lenders may circle like vultures at this stage.

Are there healthy routes to short term credit? Absolutely. Three outlets can provide safe short-term loans for the cautious small business owner.

Lines of Credit and Online Short-Term Loans

Always beware of unethical practices by creditors. Predatory lenders often exploit smaller business owners with exorbitant Annual Percentage Rates or APRs and crushing terms. Of course, businesses do need a cushion when a crisis arises. This cushion could be hard cash in a savings account or a line of credit from any of a variety of lenders, including mortgagers and small banks.

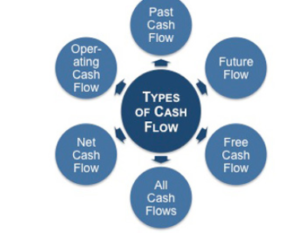

As discussed in our previous blog posts, cash flow poses issues for many business owners. You need money to make money, right? A trustworthy lender usually asks two things from a small business for a simple line of credit: At least six months in business, and at least $50,000 in annual revenue. Short of these requirements, Veteran Business Owners should give a second look to any lender offering short-term lines of credit. A line of credit may provide the “emergency fund” to protect a business in cases of a short-term crisis.

At a pinch, an online short-term loan may offer a tempting alternative. Direct cash from a lender may provide another “safety net.” However, absent reasonable terms, business owners should look elsewhere before contracting with lenders that seem too eager to dispense short-term capital. Their collections efforts will likely haunt them afterword.

Most online short-term loans have similar terms as lines of credit. A decent credit score tends to hold greater significance when the lender offers hard cash outright. These loans offer further risks, and the lenders use even more caution when approving short-term cash.

These loans can range from four to five digits. However, bear in mind that the payback period can range from three to eighteen months. Creditors will want their money in the meantime. Lenders will also wield greater leverage in negotiations for payment plans and repayment terms. In short, despite the occasional necessity of short-term money, lenders inevitably demand their pound of flesh afterward.

Equipment Loans

These loans are a different sort of animal. Lenders foreclose on the equipment itself in case of default on these loans. Such equipment may include kitchen equipment, warehouse machines, and even company-owned mobile devices. Most lenders expect more security from business owners for such loans, since damage to equipment can greatly decrease its value following repossession.

Trustworthy lenders generally expect eleven months in business, a decent credit score, and $100,000 in annual revenue before securing a necessary piece of equipment. The risk to the lender is greater, so the contractual terms place more responsibility on the borrower.

When to Use a Short-Term Line of Credit?

All businesses (and even individuals) should ideally have an emergency fund. Lines of credit and short-term online loans may plausibly furnish that cushion. Additionally, Veteran Business Owners may lack investment funds during their idea’s development phase. In the case of shorter loans and payment plans, both lenders and borrowers generally should recognize the urgency of repayment. Hence, everyone should apply a fine-tooth comb to short-term financing. Short-term lenders can be as sketchy as they are sometimes necessary.

VAMBOA, the Veterans and Military Business Owners Association hopes that this article has not only been valuable but provided some unique perspective. We work hard to bring you important, positive, helpful, and timely information and are the “go to” online venue for Veteran and Military Business Owners. VAMBOA is a non-profit trade association. We do not charge members any dues or fees and members can also use our seal on their collateral and website. If you are not yet a member, you can register here:

https://vamboa.org/member-registration/

We also invite you to check us out on social media too.

Facebook: https://www.facebook.com/vamboa

Twitter: https://twitter.com/VAMBOA

Do not forget that VAMBOA members receive significant discounts on technology needs. Check them out here:

https://vamboa.org/dell-technologies/