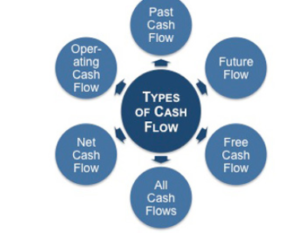

Varieties of Cash Flows

By Debbie Gregory.

Cash flows in and flows out. Cash flow is important and is a key indicator of a company’s health. As discussed in the previous article, cash flow is different from profitability. Cash flow measures the liquid assets on hand, while profitability relates more to the long-term expansion of the company.

Different types of income and expenses break into different categories of cash flow. We can break these down into (1) “operating cash flow,” (2) “investing cash flow,” (3) “financing cash flow,” and (4) “other cash flow.”

Differentiating types of cash flow helps businesses create a cash flow statement. These statements are important both for internal accounting and tax purposes. Each type of cash flow may require its own equation for records maintenance. These records are important for any company’s operations procedures, regardless of the company’s size.

- Operating Cash Flow

“Operating cash flow” comes from a variety of sources. On the incoming side of the equation, “operating cash flow” might include the direct cash revenue from goods or services is one such source. Outgoing cash flow might be employees’ wages, purchase of supplies or equipment, utility bills, overhead, or payments on loans. Other types of operating cash flow, besides direct revenue, may include interest on loans and payments from lawsuits. The most common formula for “operating cash flow” is the following: Net Income + non-cash expenses + changes in working capital.

- Investing Cash Flow

“Investing cash flow” may or may not be relevant depending on the size or operations of the business. Such cash flow may be incoming or outgoing. Examples may include business acquisitions, insurance settlements, or loans originating from the business or business owner. Generally, the equation from “investing cash flow” is earnings from any investments minus any liabilities, such as loan payments or insurance liabilities.

- Financing Cash Flow

“Financing cash flow” moves between owners, investors, and creditors. The owners themselves could move cash into the company from their own savings or other income sources. Aside from owners, investors or creditors may contribute to the financing of the company. Investors, for their part, could overlap with creditors, who could issue loans or other financial arrangements.

In consideration of the interests of investors and creditors, owners should consider the appropriateness of moving cash out of the company coffers, depending on circumstances. The most common formula for “financing cash flow” is the following:

Financing Activities Cash Flow = CED – (CD + RP). This formula could help a company issue a cash flow statement.

- Other Cash Flow

Other types of cash flow might involve charitable contributions, earnings or costs for company events, or any variety of incentives for employees, assuming use for the company’s business purposes. Calculation methods may defer to the owner’s convenience and operations procedures.

- Cash Flow Statements

The above four categories suggest methods of organization for cash-flow statements, for record-keeping purposes. Companies should issue a cash flow statement at least quarterly. The company’s management may use the above classifications at their discretion. However, the statements themselves are necessary records for any company’s archives, both for outside requests and internal reference.

We hope that you have enjoyed this article and the prior one on profitability. We work hard to bring our audience timely and important information.

We do not charge members any dues or fees. If you are not yet a member of VAMBOA, please join here: https://vamboa.org/member-registration/

Members may use our seal on their web sites and collateral and will receive special discounts and other important information.