Tax Questions for Small Business Owners

By Debbie Gregory.

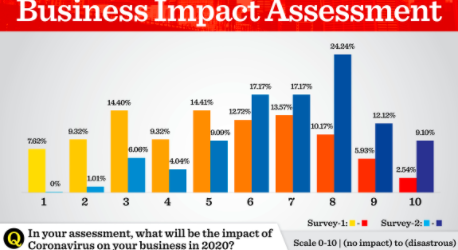

The year 2020 has been a very shaky on numerous levels. Many small businesses have been negatively impacted by the COVID-19 pandemic. There are some that have continued to operate profitably and even experience growth with the help of government loans, tax credits, and payroll deferrals.

All have seen drastic changes to their income, workforce, supply chains, and customers. As we head into the holiday season and New Year it is time to focus on what your potential tax liabilities for 2020 will be. What are the questions you should discuss with your accountant or tax professional to plan appropriately and not be surprised?

Below are five tax related issues that immediately come to mind that you will want to discuss:

1.) Will the government stimulus check impact my taxes?

The answer is both yes and no. It depends on the programs and assistance you may have taken or not taken. Below are three of the most popular COVID assistance programs and if they will help or harm your taxes for 2020:

- If you participated in the Paycheck Protection Program (PPP) you will not be taxed on any loans you took under that program. However, any expenses incurred that are eligible for forgiveness are not tax deductible that may create a tax liability for you.

- If you paid any employees for time off under the Families First Coronavirus Relief Act, you will be entitled to a tax credit once this year ends.

- If you deferred payroll taxes, you will still owe them; you simply delayed when you needed to pay them.

2.) How does working from home impact taxes?

You and your employees who are working from home may be able to deduct expenses incurred from running an office out of your homes. Some of the expenses may include such items as the space you used, equipment, utilities, etc. However, if your employees are working from home out-of-state you may be liable for higher payroll taxes than your home state charges. It really depends on the makeup of your company and employees if you may be facing any potential tax liabilities or benefits.

3.) Should I be saving more for my retirement?

Most of the current workforce working from home has seen a dramatic decrease in the amount of money they spend on food, going out to restaurants, entertainment and other consumer goods that may translate into building greater savings. Now is a very good time to put those savings away for the future. Consider contributing more to your 401(k) or IRA accounts.

4.) Is now a good time to invest in capital equipment?

Right now, there are a lot of outstanding deals out there and interest rates are very low too. Lots of businesses are taking advantage of that fact and are buying needed equipment, furniture, technology, and other capital items at steep discounts. A lot of these purchases are deductible and can equal huge tax savings.

5.) Can I estimate my 2020 taxes based on last year?

Candidly, 2020 has been so chaotic and unprecedented that your estimation based on the prior year should be tossed out the window! You may have made way less this year than anticipated, or way more, and your actual tax implication may not even properly reflect the reality of your income. Take a close look at how your business did this year overall to make a better estimation of what your taxes may be.

Taxes are an unavoidable and annual huge expense for all of us. This year taxes are going to be more confusing and difficult than ever before. The earlier you can get together with your accountant or tax professional to go over what your potential tax liability will be, the better it will be, and you can prepare accordingly. These are questions that you need to address with your account or tax professional.

If you are looking at updating your technology, please check out the very significant discounts being extended to VAMBOA family and friends by Dell Technologies. Here is a link to check them out: https://vamboa.org/dell-technologies/